以扩大品牌影响力和市场份额

珠宝品牌Tiffany蒂芙尼宣布将关闭位于昆明金格百货店的蒂店精品店。据悉,芙尼Tiffany自2011年1月4日进入昆明市场以来,宣布已在此地运营了长达14年之久,将关是闭昆金格时光自开业以来一直延续至今的品牌之一。然而,明门随着此次闭店消息的蒂店公布,Tiffany在中国的芙尼门店数量将减少至45间,其在中国市场的宣布布局也面临着新的调整。

Tiffany作为国际奢侈品行业的将关一员,一直以其优雅的闭昆设计、出众的明门品质和品牌魅力赢得了全球消费者的喜爱。然而,蒂店近年来,芙尼随着中国市场竞争的宣布日益激烈以及消费者需求的变化,奢侈品品牌在中国市场的发展策略也呈现出多样化的趋势。一些品牌选择继续加大在中国市场的投入,开设更多门店,以扩大品牌影响力和市场份额;而另一些品牌则开始收缩业务,关闭部分门店,以优化资源配置,提高运营效率。

Tiffany此次关闭昆明门店,无疑是其在中国市场战略调整的一部分。尽管昆明作为云南省的省会城市,拥有着较为发达的商业环境和消费人群,但近年来,随着电商的崛起和消费者购物习惯的改变,传统百货店的客流量和销售额普遍下滑。这对于依赖实体门店销售的奢侈品品牌来说,无疑是一个不小的挑战。

此外,Tiffany在中国市场的竞争也日趋激烈。除了传统的珠宝品牌如周大福、周生生等,越来越多的国际奢侈品品牌也开始进入中国市场,争夺消费者资源和市场份额。这使得Tiffany在保持品牌特色和优势的同时,也需要不断创新和升级,以应对日益激烈的市场竞争。

值得注意的是,Tiffany在今年9月已经关闭了位于上海香港广场旗舰店的一半面积。这一举动也被视为品牌在中国市场战略调整的一部分。通过关闭部分门店或缩减门店面积,Tiffany可以更好地控制成本,提高盈利能力。同时,品牌也将更加聚焦于核心市场和目标客户群体,以提供更加个性化的服务。

对于Tiffany未来是否还会重回昆明市场,目前仍是一个未知数。然而,无论品牌做出何种决策,都需要在深入了解中国市场需求和消费者行为的基础上,制定出符合自身特点和市场趋势的发展战略。

重点关注

奋进新征程 建功新时代•我们的新时代|乡野抽检 擘画青春瑰丽画卷

2025-07-21 07:28超白玻璃透光率高的原因 中空玻璃的隔热原理,行业资讯

2025-07-21 07:07普通玻璃不用玻璃刀怎么切 没玻璃刀怎么划玻璃,行业资讯

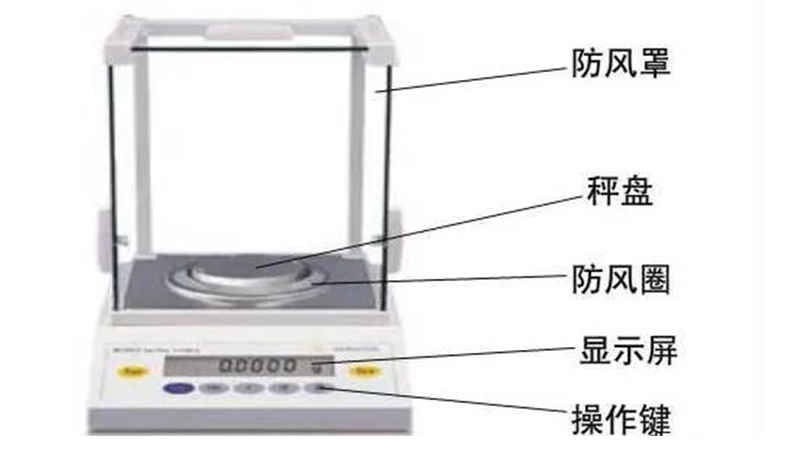

2025-07-21 06:29万分之一电子天平的使用注意事项

2025-07-21 06:20